It looks at how much cash is left over after operating expenses and capital expenditures are accounted for. In general, the higher the free cash flow is, the healthier a company is, and in a better position to pay dividends, pay down debt, and contribute to growth. Effective cash flow management is crucial for ensuring a company’s financial stability and sustainability. By closely monitoring cash inflows and outflows, businesses can identify potential cash shortages or surpluses, allowing them to take proactive measures to maintain a healthy cash balance.

Positive Cash Flow

In short, investors want to see whether and how a company is investing in itself. A company must understand how well it is generating cash and how much it has. When you track your finances, including where cash comes from and where it goes, you can place yourself in a better position to plan business activities and company operations that lead to profits and growth. Companies, investors, and analysts examine cash flow for various reasons, including for insight into a company’s financial stability and health and to inform decisions about possibly investing in a company. Negative cash flow from investing activities might be due to significant amounts of cash being invested in the company, such as research and development (R&D), and is not always a warning sign. Changes in cash from investing are usually considered cash-out items because cash is used to buy new equipment, buildings, or short-term assets such as marketable securities.

Cash Flow Statement vs Income Statement vs Balance Sheet

Value investors often look for companies with high or improving cash flows but with undervalued share prices. Rising cash flow is often seen as an indicator that future growth is calculate cash flow from assets likely. It’s important to note that an exceedingly high FCF might indicate that a company is not investing in its business properly, such as updating its plant and equipment.

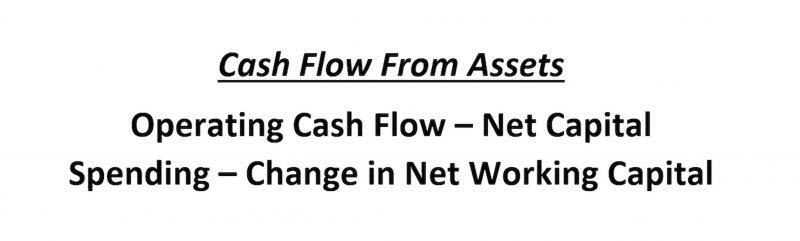

Formula and Calculation of Cash Flow

- It measures a company’s ability to generate cash inflows from its core operations using strictly its current assets and fixed assets.

- Once you have a cash flow figure, you can use it to calculate various ratios (e.g., operating cash flow/net sales) for a more in-depth cash flow analysis.

- It means that core operations are generating business and that there is enough money to buy new inventory.

- However, it does not measure the efficiency of the business in comparison to a similar industry.

- The purchasing of new equipment shows that the company has the cash to invest in itself.

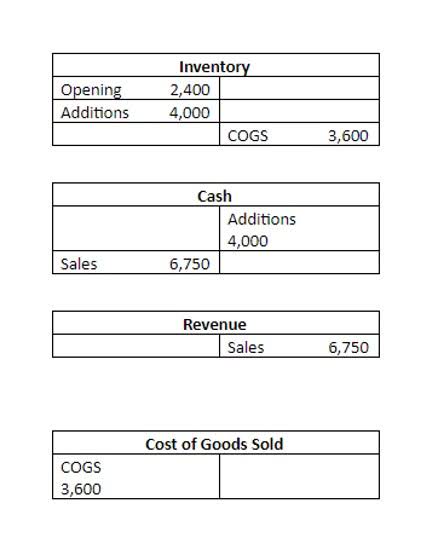

- A basic way to calculate cash flow is to sum up figures for current assets and subtract from that total current liabilities.

- A cash flow statement is a valuable measure of strength, profitability, and the long-term future outlook of a company.

It reports revenue as income when it’s earned rather than when the company receives payment. Expenses are reported when incurred, even though no cash payments have been made. A cash flow statement lays out the sources of your cash and where you have used it. Study a statement to determine where changes might be made to better utilize cash, run a business more efficiently, and grow it more effectively. For investors who prefer dividend-paying companies, this section is important because, as mentioned, it shows cash dividends paid. This section reports the amount of cash from the income statement that was originally reported on an accrual basis.

How to calculate net cash flow from operating activities?

- Free cash flow is an important measurement since it shows how efficient a company is at generating cash.

- However, this could also mean that a company is investing or expanding which requires it to spend some of its funds.

- Together with the financial ratio return on invested capital, FCF can give a complete understanding of management’s ability to make the company grow.

- The sale would be an accounts receivable with no impact on cash until collected.

- These figures can also be calculated by using the beginning and ending balances of a variety of asset and liability accounts and examining the net decrease or increase in the accounts.

- Cash flow statements are important as they provide critical information about the cash inflows and outflows of the company.

This makes FCF a useful instrument for identifying growing companies with high upfront costs, which may eat into earnings now but have the potential to pay off later. The indirect method starts with net income and adjusts for non-cash items, such as depreciation and changes in working capital. This method is often preferred by companies due to its simplicity and the fact that it can be prepared using data from the income statement and balance sheet.

This might mean renting out unused space or machinery, ensuring equipment operates at optimal capacity, or diversifying product lines. Avoiding overstocking and instead focusing on just-in-time inventory systems can reduce holding costs and free up cash. Note why and where you’re overstocking and develop a written plan that makes your process more efficient going forward. Ways to optimize your operations can include improving supply chain management, reducing downtime in production, and implementing lean manufacturing practices. There are two main approaches to calculating FCF, and choosing between them will likely depend on what financial information about a company is readily available.

Using this method, cash flow is calculated through modifying the net income by adding or subtracting differences that result from non-cash transactions. This is done in order to come up with an accurate cash inflow or outflow. This section records the cash flow between the company, its shareholders, investors, and creditors.

Free Cash Flow (FCF): Formula to Calculate and Interpret It

In a sort of way, cash flow yield is like the earnings yield (reciprocal of price/earnings ratio) because both compare profits to the stock price. However, the former is more reliable because only cash amounts enter into consideration. Using the indirect method, calculate net cash flow from operating activities (CFO) from the following information. Increasing CFFA is essential to improve liquidity, fund expansion initiatives, and fortify their financial resilience, and various strategies can enhance CFFA and contribute to long-term sustainability. By streamlining processes, businesses can minimize waste and inefficiencies, ultimately reducing operational costs and enhancing cash flow. This may involve implementing lean manufacturing practices, improving supply chain management, and minimizing downtime in production.

One drawback to using the free cash flow method is that capital expenditures can vary dramatically from year to year and among different industries. That’s why it’s critical to measure FCF over multiple periods and against the backdrop of a company’s industry. From 2020 until now, Macy’s capital expenditures have been increasing due to its growth in stores, while its operating cash flow has been decreasing, resulting in decreasing free cash flows. Three ways to calculate free cash flow are by using operating cash flow, using sales revenue, and using net operating profits. You can also use amortization and depreciation to account for the decreasing value of equipment and plants. Regularly monitoring and analysing cash flow is essential for ensuring a business’s financial health.

- Whether a company obtains financing through debt or equity, it is always possible to track the free cash flow and see its impact against debt service (interest + principal) or share dilution.

- Learn how a company calculates free cash flow and how to interpret that FCF number to choose good investments that will generate a return on your capital.

- Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018.

- The bulk of the positive cash flow stems from cash earned from operations, which is a good sign for investors.

- Proceeds from issuing long-term debt, debt repayments, and dividends paid out are accounted for in the cash flow from the financing activities section.

- A positive CFFA suggests that a company generates adequate cash to meet its immediate obligations, reducing its dependence on external funding.